Introduction:

Are you considering looking at emi for 40 lakh home loan for 20 years? For many individuals and families, buying a home represents a significant financial milestone. It’s not just about having the perfect property; That includes a financial commitment necessary to pay down the home loan. One of the most important aspects of a home loan is the monthly equivalent amount (EMI), which determines how much you will have to pay to repay the loan each month. In this blog post, we will analyze the EMI specifications of a 40 lakh home loan for 20 years to help you understand the repayment plan and make an informed decision.

What is EMI?

EMI stands for Equated Monthly Installment. This is the exact amount you pay to the lender to pay off your home loan each month. EMI consists of accumulated principal and interest. Initially, a large chunk of your EMI goes towards interest payments, while the rest goes towards principal reduction. Over time, the ratio of principal to payments increases, decreasing the interest component.

Understanding a Emi for Home Loan of 40 Lakhs for 20 Years:

Write down the implications of taking a home loan of Rs 40 lakhs for a tenure of 20 years. The principal amount, in this case, is 40 lakhs. The interest rate offered by the lender will determine the interest portion of your EMI. For example, if the interest rate is 8% per annum, the interest portion of each EMI will be calculated based on this rate. The 20-year term determines how long you will repay the loan.

Factors Affecting Home Loan EMIs:

Several factors affect the EMI amount for a home loan:

- Benefits: Higher interest rates lead to higher EMI and vice versa. Staying alert to interest rate fluctuations is important to understanding how they affect your repayments.

- Loan: The longer the term, the lower the EMI, but the higher the total interest payment. The temporary arrangement increases the EMI but reduces the total interest payable.

- Repayment Scheme: Home loan EMIs are arranged according to repayment schedule, which determines how much of each EMI goes towards principal repayment and how much goes towards interest

Calculating EMI for a 40 Lakhs Home Loan:

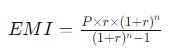

The formula for calculating EMI is:

Where:

- 𝑃 = Principal amount (loan amount)

- 𝑟 = Monthly interest rate

- 𝑛 = Loan tenure in months

Let’s consider an example:

- Principal amount (P) = 40 lakhs

- Annual interest rate = 8% (0.08)

- Loan tenure = 20 years (240 months)

After calculating, we find the EMI to be approximately 33,458 INR.

Documents required for 40 lakh home loan for 20 years

Applying for a home loan will usually require you to provide various documents to the lender to verify your personality, financial stability and ability to repay the loan. Here is a list of the most frequently searched documents:

Proof of Identity and Address::

- Aadhaar Card: The government issued Aadhaar card is a proof of identity and address.

- Passport: Passport is another valid proof of identity which also serves as proof of address.

- Voter ID Card: Voter ID cards are generally accepted as proof of identity and address.

Proof of Income:

- Salary Slip: Provide your latest pay slips for the past three to six months as required by the lender.

- Income Tax Returns (ITR): Submit your income tax returns for the last two to three years to ensure your income is stable.

- Form 16: If you are a salaried employee, submit your Form 16 issued by your employer as proof of income.

- Bank statements: Submit bank statements for the past six months to a year to show where you earn money and financial transactions.

Employment Proof:

- Employment Letter: Provide a letter from your employer detailing your employment, including your title, salary and hours.

- Letter of Appointment: Submit your letter of appointment to verify your employment status and terms of employment.

Property Documents:

- Property Sales Agreement: Once the property is finalized, provide a copy of the contract between you and the seller.

- Property Deed: File a property deed to verify ownership of one’s legal rights.

- Building Plan Approval: Provide an approved building plan from the local municipal authority or relevant government agency.

- No Objection Certificate (NOC): Obtain an NOC from the architect or housing association to confirm that there is no legal conflict or encumbrance

Additional Documents:

- Proof of co-ownership and address: When applying for a co-sponsored loan, provide proof of co-worker identity and address.

- Loan Application Form: Complete the loan application form provided by the lender accurately and completely.

- Passport Size Photographs: Include a recent passport size photograph as specified by the lender.

- Credit Report: Some lenders may require a copy of your credit report to verify your creditworthiness and repayment history.

Note:

- Documentation Requirements May Vary: Documentation requirements may vary from lender to lender and depending on the type of loan you are applying for.

- Check with Your Lender: Before applying for a loan, it’s a good idea to check with your lender about their specific documentation requirements to ensure a smooth application process.

- Keep a Copy: Make sure you have a copy of all the paperwork you have sent for your records and for future reference.

You can improve your chances of approval by streamlining the loan application process by gathering and submitting the necessary documents accurately and submitted.

To check how to reduce interest rate on home loan read this blog

To understanding about the eligibility of home loan read our blog

Tips for Managing Home Loan EMIs:

- Budgeting: It is important to create a budget along with your EMI payments. This will help you manage your finances and ensure you don’t miss payments.

- Prepayment options: Consider making a down payment on your home loan whenever possible. This can help reduce the overall interest burden and repay the loan faster.

- Refinancing: If you find that other lenders offer better interest rates or terms, look for refinancing options. Refinancing can help lower your EMI or shorten the tenure of the loan.

How to apply for a ₹40 lakh home loan

Below are the step to apply for Home Loan:

- Determine Eligibility:

- Minimum age: 21 years

- Maximum age at loan maturity: 60 years (salaried) / 65 years (self-employed)

- Stable source of income

- Good credit score (usually 700+)

- Documents Required:

- Identity proof (Aadhar, PAN card)

- Address proof (utility bills, rental agreement)

- Income proof (salary slips, bank statements, ITR for self-employed)

- Property documents (title deed, NOC from builder)

- Choose the Right Lender:

- Compare interest rates, processing fees, and other charges

- Check lender’s reputation and customer service

- Calculate Loan Eligibility:

- Use online loan eligibility calculators

- Consider factors like monthly income, existing debts, and credit score

- Application Process:

- Fill out the loan application form (online or offline)

- Submit necessary documents

- Pay processing fee

- Loan Approval Process:

- Lender evaluates credit score and financial status

- Property verification and legal check by the lender

- Lender may conduct a personal discussion/interview

- Sanction and Disbursement:

- Loan sanction letter issued with terms and conditions

- Sign loan agreement

- Disbursement of loan amount as per the construction stage of the property or full amount for ready-to-move-in properties

- Repayment:

- Choose a suitable EMI option

- Set up auto-debit from your bank account for EMIs

- Tax Benefits:

- Claim deductions on principal repayment under Section 80C

- Claim deductions on interest paid under Section 24

Ensure to maintain a good credit history and keep thorough records of all transactions and communications with the lender throughout the process.

Service Tags : – 40 lakh home loan emi for 25 years | emi for 40 lakhs home loan for 20 years | What is EPF Account Number | Line of Credit How Much Can I Get | EPF Account Number | Check Provident Fund Balance Online | Loan EMI Calculator online | house building loan emi calculator | Emi Home Loan Calculator | Monthly Home Loan EMI Calculator | Top up loan on home loan | Home Loan EMI Eligibility Calculator | interest rate on home loans | Best EMI Calculator | How to Check Provident Fund Balance Online | Loan EMI Calculator for Business Loans | Business Loan Emi Calculator | calculate loan amount based on payment | Monthly Emi Home Loan Calculator | new car emi calculator | how much can you get with a personal loan | what is top up loan on home loan | house loan eligibility based on salary | how to reduce the interest rate on home loans | EMI Calculator | 25 Lakh Business Loan EMI Calculator | Guide to Securing ₹25 Lakh and Repayments | Emi for 40 lakh home loan for 20 years | 40 Lakh Home Loan EMI for 25 Years | Check House Loan Eligibility Based on Salary 2024

FAQs (EMI for 40 lakhs home loan for 20 years)

How is EMI calculated for a home loan?

EMI calculation involves a complex formula that considers the principal amount, interest rate, and loan tenure. It’s typically calculated using mathematical formulas, but emiscalculator’s online EMI calculators are also available for convenience.

What factors influence the EMI amount for a home loan?

Several factors affect the EMI amount:

Principal amount

Interest rate

Loan tenure

Amortization schedule

What is the tenure of a home loan?

The tenure of a home loan refers to the duration over which the borrower agrees to repay the loan. It’s typically measured in years, with common tenures ranging from 10 to 30 years.

Can I change the tenure of my home loan?

Yes, some lenders may allow borrowers to modify the tenure of their home loan, either by extending or reducing it. However, this may impact the EMI amount and total interest paid over the loan term.

How does prepayment affect my home loan EMI?

Prepayment involves repaying a portion of the outstanding loan amount before the scheduled tenure ends. This can help reduce the total interest paid over the loan term and may result in lower EMIs or a shorter tenure.

What documents are required to apply for a home loan?

Commonly required documents include:

Identity and address proof

Proof of income

Employment proof

Property documents

Additional documents like passport-sized photographs and loan application form

Can I transfer my home loan to another lender?

Yes, home loan transfer or refinancing allows borrowers to switch from one lender to another for better terms, such as lower interest rates or extended tenure.

What happens if I miss an EMI payment?

Missing an EMI payment can lead to penalties, late fees, and negatively impact your credit score. It’s essential to communicate with your lender and explore options like EMI rescheduling to avoid defaulting on payments.

How can I manage my EMI payments effectively?

Effective EMI management involves budgeting, financial planning, timely payments, and exploring options like prepayment or refinancing to optimize loan repayment.

Conclusion:

Understanding the EMI for 40 lakh home loan for 20 years is essential for anyone considering buying a home. By grasping the factors that influence EMIs and how they are calculated, you can make informed decisions about your home loan. Remember to budget effectively, consider prepayment options, and stay informed about interest rate fluctuations to manage your home loan efficiently. A well-thought-out repayment plan will not only help you repay your loan comfortably but also achieve financial security in the long run.

- What is EPF Account Number?

- How to Check Provident Fund Balance Online (EPFO) 2024

- Calculate business loan Emi | Using a Loan EMI Calculator for Business Loans

- Business Loan Emi Calculator: A Complete Guide to Securing ₹25 Lakh and Managing Repayments with an EMI Calculator

- Calculate EMI for 40 Lakhs Home Loan for 20 Years with emi calculator

- Caclulate 40 Lakh Home Loan EMI for 25 Years using emi calculator India 2024

- Calculate Loan Amount Based on Payment

- Monthly Emi Home Loan Calculator India 2024 (Emi calculator for home loan principal and interest)

- New Car EMI Calculator India 2024 (New car loan emi calculator India)

- How much can you get with a personal loan (How Much Will I Qualify for a Personal Loan)