Are you considering taking out a 40 lakh home loan emi for 25 years or 20 years or 15 year or 10 years ? Understanding your Equated Monthly Installments (EMI) is crucial to managing your finances effectively. In this comprehensive guide, we’ll delve into everything you need to know about 40 lakh home loan EMIs, from calculating your EMI using a reliable emiscalculator’s calculator to understanding eligibility criteria and necessary documents. Let’s dive in!

Understanding 40 Lakh Housing Loan EMI Details

EMI is a fixed payment made towards repaying both the principal amount and the interest on your home loan. By knowing EMI amount, you can plan your monthly budget effectively and making sure timely repayments.

How to Calculate 40 Lakh Home Loan EMI?

Calculating EMI manually can be complex, but thanks to modern technology, online EMI calculators make it simple. We’ll walk through the steps to accurately how to know or calculate EMI.

Utilizing the 40 Lakh Home Loan EMI Calculator

A reliable emiscalculator’s EMI calculator takes input as loan amount, interest rate, and loan tenure to provide you with an accurate EMI amount. Lets have a look, how to use emiscalculator’s tool effectively.

Let’s use Home loan emi calculator with following parameters for our calculation:

- Loan Amount: ₹40,00,000 (40 lakhs)

- Interest Rate: 7.5% per annum

- Loan Tenure: 25 years

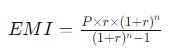

Using the formula for calculating EMI:

Where:

- 𝑃 = Loan amount (Principal)

- 𝑟 = Monthly interest rate (Annual interest rate divided by 12)

- 𝑛 = Loan tenure in months

After performing the calculations, the estimated EMI for a 40 lakh home loan for 25 years at an interest rate of 7.5% per annum is approximately ₹29,560.

Eligibility Criteria for a 40 Lakh Home Loan

Before applying for a 40 lakh home loan, it’s essential to understand the eligibility criteria set by lenders. Factors such as income, age, employment stability, and credit score play a crucial role in determining your eligibility.

40 Lakh Home Loan EMI for 5 Years

For a 40 lakh home loan with a tenure of 5 years:

- Loan Amount: ₹40,00,000

- Interest Rate: 7.5% per annum

- Loan Tenure: 5 years (60 months)

After performing the calculations, the estimated EMI for a 40 lakh home loan for 5 years at an interest rate of 7.5% per annum is approximately ₹80,152.

40 Lakh Home Loan EMI for 10 Years

For a 40 lakh home loan with a tenure of 10 years:

- Loan Amount: ₹40,00,000

- Interest Rate: 7.5% per annum

- Loan Tenure: 10 years (120 months)

After performing the calculations, the estimated EMI for a 40 lakh home loan for 10 years at an interest rate of 7.5% per annum is approximately ₹47,481.

40 Lakh Home Loan EMI for 15 Years

For a 40 lakh home loan with a tenure of 15 years:

- Loan Amount: ₹40,00,000

- Interest Rate: 7.5% per annum

- Loan Tenure: 15 years (180 months)

After performing the calculations, the estimated EMI for a 40 lakh home loan for 15 years at an interest rate of 7.5% per annum is approximately ₹37,080.

40 Lakh Home Loan EMI for 20 Years

Calculating the EMI for a 40 Lakh home loan over a 20-year period is crucial for prospective homeowners to plan their finances effectively. With the aid of online EMI calculators or specialized financial software, individuals can determine the monthly installment they’ll need to repay, considering factors like the loan amount, interest rate, and loan tenure. By inputting these variables into the calculator, borrowers can obtain a detailed breakdown of their monthly payments, including both principal and interest components. This enables borrowers to make informed decisions regarding their home loan, ensuring that they can comfortably manage their finances throughout the loan tenure.

For a 40 lakh home loan with a tenure of 20 years:

- Loan Amount: ₹40,00,000

- Interest Rate: 7.5% per annum

- Loan Tenure: 20 years (240 months)

After performing the calculations, the estimated EMI for a 40 lakh home loan for 20 years at an interest rate of 7.5% per annum is approximately ₹32,224.

40 Lakh Home Loan EMI for 25 Years

Planning for a 40 Lakh home loan EMI spread across 25 years demands careful consideration and financial foresight. Prospective homeowners can use various online tools or specialized financial software to calculate their monthly installments accurately. By entering key details such as the loan amount, interest rate, and tenure, borrowers can obtain a comprehensive breakdown of their EMI, including principal and interest components. This insight empowers borrowers to make informed decisions about their housing finances, ensuring they can comfortably manage their monthly payments and achieve their homeownership goals without financial strain.

For a 40 lakh home loan with a tenure of 25 years:

- Loan Amount: ₹40,00,000

- Interest Rate: 7.5% per annum

- Loan Tenure: 25 years (300 months)

After performing the calculations, the estimated EMI for a 40 lakh home loan for 25 years at an interest rate of 7.5% per annum is approximately ₹29,560.

40 Lakh Home Loan EMI for 30 Years

Calculating the EMI for a 40 Lakh home loan spread over 30 years requires careful financial planning and consideration. Utilizing online tools or specialized financial software, prospective homeowners can determine their monthly installments accurately. By inputting essential details such as the loan amount, interest rate, and tenure, borrowers can receive a detailed breakdown of their EMI, encompassing both principal and interest components. This comprehensive insight enables borrowers to make informed decisions regarding their housing finances, ensuring they can comfortably manage their monthly payments over the extended loan tenure, ultimately facilitating their journey towards homeownership.

For a 40 lakh home loan with a tenure of 25 years:

- Loan Amount: ₹40,00,000

- Interest Rate: 7.5% per annum

- Loan Tenure: 30 years (360 months)

After performing the calculations, the estimated EMI for a 40 lakh home loan for 30 years at an interest rate of 7.5% per annum is approximately ₹27,969.

These calculations provide insights into the EMIs for different loan tenures, allowing borrowers to make informed decisions based on their financial capabilities and preferences.

Documents Required for a 40 Lakh Home Loan

When applying for a 40 lakh home loan, you’ll typically need to provide several documents to the lender to support your application. Here’s a list of commonly required documents:

- Identity Proof:

- Aadhar Card

- Passport

- Voter ID Card

- Driving License

- PAN Card

- Address Proof:

- Aadhar Card

- Passport

- Voter ID Card

- Utility bills (Electricity, Water, Gas) – recent

- Property tax receipt

- Bank statement with address (for the last 6 months)

- Income Proof (for Salaried Individuals):

- Salary slips for the last 3 to 6 months

- Form 16 issued by the employer

- Bank statements showing salary credits for the last 6 months

- Income Proof (for Self-Employed Individuals):

- Income Tax Returns (ITR) for the last 2 to 3 years

- Profit & Loss Statement

- Balance Sheet

- Business registration documents (if applicable)

- Employment Proof (for Salaried Individuals):

- Employment appointment letter

- Employee ID card

- Letter from employer confirming employment details and salary

- Property Documents:

- Sale deed or agreement of sale

- Allotment letter from builder/society

- NOC (No Objection Certificate) from builder/society

- Property tax receipts

- Title deed documents

- Encumbrance certificate

- Bank Statements:

- Savings account statements for the last 6 to 12 months

- Loan statements (if any)

- Credit Score Report:

- CIBIL score or any other credit bureau report

- Other Documents:

- Passport-size photographs

- Duly filled loan application form

- Cheque for processing fee

It’s essential to provide clear and accurate copies of these documents to facilitate the loan approval process. Additionally, lenders may request additional documents based on their specific requirements and policies. Before applying for the loan, it’s advisable to check with the lender for the complete list of required documents to ensure a smooth application process.

Things to Keep in Mind While Applying for a 40 Lakh Home Loan

When applying for a 40 lakh home loan, several factors need consideration to ensure a smooth and successful application process. Here are some essential things to keep in mind:

- Evaluate Your Financial Position: Assess your financial situation thoroughly to determine if you can afford the loan. Consider factors such as income, existing debts, expenses, and future financial goals.

- Check Your Credit Score: A good credit score significantly impacts your loan approval chances and interest rates. Ensure your credit report is accurate and work on improving your score if necessary before applying for the loan.

- Compare Lenders: Research and compare various lenders, including banks and non-banking financial institutions (NBFCs), to find the best loan terms, interest rates, and repayment options that suit your needs.

- Understand Loan Terms: Familiarize yourself with loan terms such as interest rates, loan tenure, processing fees, prepayment charges, and other associated costs. Clear any doubts regarding the terms and conditions before signing the loan agreement.

- Assess Eligibility Criteria: Understand the eligibility criteria set by lenders, including minimum income requirements, employment stability, age criteria, and credit score requirements. Ensure you meet the eligibility criteria before applying for the loan.

- Gather Required Documents: Prepare all necessary documents, including identity proof, address proof, income proof, property documents, and others, as per the lender’s requirements. Ensure the documents are accurate and up-to-date.

- Calculate EMI Affordability: Use an emiscalculator’s EMI calculator to estimate the monthly installment amount based on the loan amount, interest rate, and tenure. Ensure the EMI is affordable within your budget and won’t strain your finances.

- Consider Down Payment: Determine the down payment amount you can afford to pay upfront. A higher down payment can lower your loan amount and EMI, reducing the financial burden in the long run.

- Plan for Additional Expenses: Besides the loan amount, consider other expenses such as registration fees, stamp duty, legal charges, insurance, and maintenance costs associated with purchasing a home. Factor these expenses into your budget.

- Read the Fine Print: Carefully read and understand the terms and conditions, fees, charges, and clauses mentioned in the loan agreement. Seek clarification on any unclear or ambiguous terms before signing the agreement.

- Seek Professional Advice if Necessary: If you’re unsure about any aspect of the home loan process, consider seeking advice from financial advisors, real estate experts, or mortgage brokers to make informed decisions.

By keeping these points in mind, you can navigate the home loan application process more effectively and increase your chances of securing a favorable loan offer that meets your needs and financial goals.

Service Tags : – 40 lakh home loan emi for 25 years | emi for 40 lakhs home loan for 20 years | What is EPF Account Number | Line of Credit How Much Can I Get | EPF Account Number | Check Provident Fund Balance Online | Loan EMI Calculator online | house building loan emi calculator | Emi Home Loan Calculator | Monthly Home Loan EMI Calculator | Top up loan on home loan | Home Loan EMI Eligibility Calculator | interest rate on home loans | Best EMI Calculator | How to Check Provident Fund Balance Online | Loan EMI Calculator for Business Loans | Business Loan Emi Calculator | calculate loan amount based on payment | Monthly Emi Home Loan Calculator | new car emi calculator | how much can you get with a personal loan | what is top up loan on home loan | house loan eligibility based on salary | how to reduce the interest rate on home loans | EMI Calculator | 25 Lakh Business Loan EMI Calculator | Guide to Securing ₹25 Lakh and Repayments | Emi for 40 lakh home loan for 20 years | 40 Lakh Home Loan EMI for 25 Years | Check House Loan Eligibility Based on Salary 2024

FAQs

What is a home loan EMI?

A home loan Equated Monthly Installment (EMI) is a fixed amount paid by borrowers to lenders each month, comprising both principal and interest components, to repay the loan over the agreed-upon tenure.

How is the EMI calculated for a 40 lakh home loan?

The EMI for a 40 lakh home loan is calculated based on the loan amount, interest rate, and tenure using the formula for EMI calculation. You can use emiscalculator’s online EMI calculators to get an accurate estimate.

What factors affect home loan eligibility?

Home loan eligibility is influenced by factors such as income, credit score, age, employment history, existing debts, property value, and the lender’s policies.

What documents are required to apply for a 40 lakh home loan?

Commonly required documents include identity proof, address proof, income proof (for salaried and self-employed individuals), property documents, bank statements, credit score report, and passport-size photographs.

What is the maximum loan tenure available for a 40 lakh home loan?

The maximum loan tenure typically ranges from 20 to 30 years, depending on the lender’s policies and the borrower’s eligibility criteria.

Can I prepay or foreclose my home loan? Are there any charges for prepayment?

Yes, borrowers can prepay or foreclose their home loans before the end of the loan tenure. However, lenders may levy prepayment charges, which vary depending on the terms of the loan agreement.

What is the difference between fixed and floating interest rates?

Fixed interest rates remain constant throughout the loan tenure, providing predictability in EMI payments. Floating interest rates, on the other hand, fluctuate based on market conditions, potentially affecting EMI amounts.

What happens if I default on my home loan EMI payments?

Defaulting on home loan EMI payments can lead to penalties, increased interest rates, legal action, and ultimately, foreclosure of the property by the lender. It’s essential to communicate with the lender and seek assistance if facing financial difficulties.

Can I transfer my existing home loan to another lender?

Yes, borrowers can opt for a home loan balance transfer to another lender offering better terms, interest rates, or services. However, there may be associated charges and documentation requirements for the transfer process.

How long does it take for a home loan to be approved?

The time taken for home loan approval varies depending on factors such as the lender’s processing time, documentation completeness, property valuation, and borrower’s eligibility. It typically ranges from a few days to a few weeks.

With this comprehensive guide, you’ll be equipped with the knowledge and tools needed to navigate the world of 40 lakh home loans confidently. Whether you’re a first-time homebuyer or looking to upgrade your current living situation, understanding your EMI is the first step towards achieving your homeownership goals. Let’s embark on this journey together!